The inventory turnover ratio formula is a little bit more complicated, but not by much.

Inventory turnover ratioĬalculating inventory turnover can help companies make better decisions on pricing, manufacturing, marketing, and purchasing new inventory.

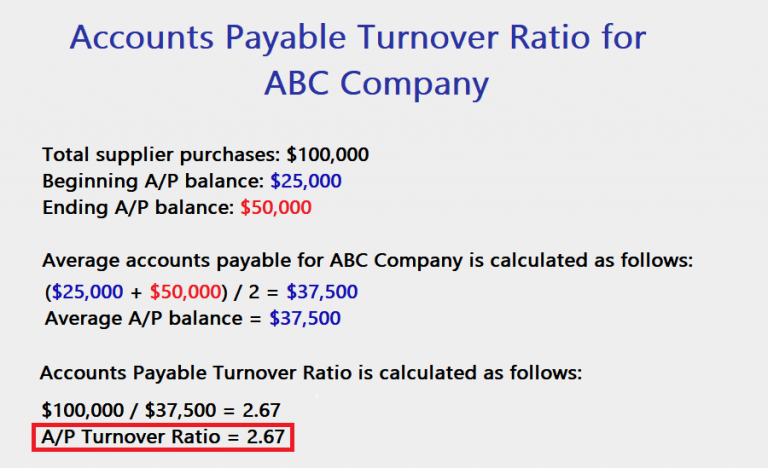

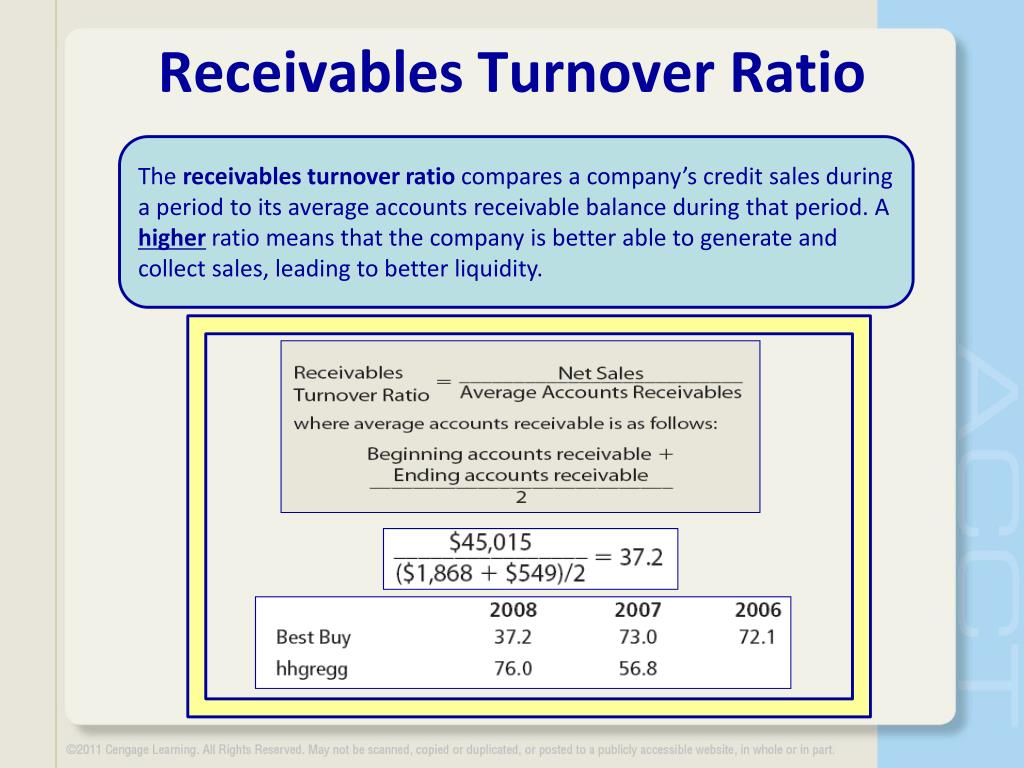

The goal is to maximize sales, minimize the receivable balance, and generate a high turnover rate. So, if you have credit sales for the month that total $400,000 and the account receivable balance is, for example, $60,000, the turnover rate is 6.7. The equation to determine the accounts receivable turnover ratio is:Īccounts Receivable Turnover Ratio = Net Credit Sales / Average Accounts Receivable This ratio shows how well a business manages the credit it extends to customers and how quickly this short-term debt is paid back. Now let us define the accounts receivable turnover ratio: it is an accounting measure used to quantify the company’s effectiveness in collecting its receivables or money owed by clients.

Ar turnover ratio equation how to#

How to calculate the sales turnover ratio? Accounts receivable turnover ratio These ratios are usually calculated on an annual basis, but it is quite common for it to be calculated quarterly too. Sales turnover ratios vary depending on the sector, so you should only compare your ratios to companies within the same industry. A lower ratio = business is not using the assets efficiently, and there are some internal problems. Generally speaking, a higher turnover ratio = company is efficiently generating sales. Yes, this can get confusing, but stay with me! They compare the dollar amount of sales or revenues to its total assets. Turnover ratios measure the efficiency with which a company generates revenue. Both assets require a heavy cash investment, and it is essential to calculate how quickly a business makes money. And the most common measures of turnover rely on ratios involving these two things. Two of the most significant assets owned by a business are inventory and accounts receivable. And even though the turnover is not necessary to report, unlike revenue, it helps to understand how to manage production levels better.īesides, we shouldn’t confuse sales turnover with the term “overall turnover,” which is a synonym for a company’s total revenues, most often used in Europe and Asia. So, although sales turnover and revenue are not quite the same, they do often correlate, as companies earn more revenue by turning over their inventory frequently. While revenue measures the profitability of the business, turnover determines its efficiency. Sales turnover is often confused with revenue, and while these terms are related, they are two different measures used to determine the success of a company.

Turnover is also used to calculate how quickly a company collects cash from accounts receivable. It will represent the value of total sales provided to consumers during this time. Most often, it is used to understand how much of its inventory a company sells within a defined period.įor example, if a business is selling mobile phones, the turnover rate would be the total amount of mobile phones sold in a year. What is sales turnover? It is an accounting concept that determines how quickly a business conducts its operations.

0 kommentar(er)

0 kommentar(er)